lechgmr.ru News

News

Refinance Heloc To Mortgage

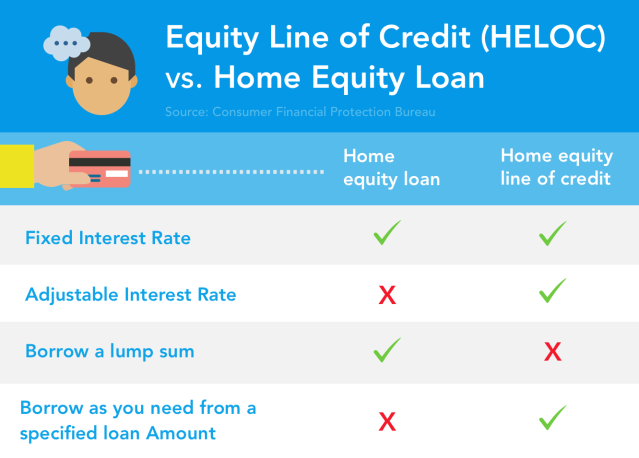

Though refinancing a mortgage and taking out a home equity loan each offers a source of cash for homeowners, the similarities stop there. Make a big purchase. Buying a car, paying for a wedding, covering college expenses. Whatever you need it for, a cash-out refinance lets you use your home's. Refinancing a HELOC is similar to refinancing a first mortgage. You will have to qualify based on your income, expenses, debts, and home value. This means. For anyone considering a home refinance, I would highly refinancing your existing mortgage at the same time as obtaining a subordinate HELOC loan. There is no true VA home equity loan option. Veterans who want to access their home equity for cash should consider a VA cash-out refinance loan. The two common types of second mortgages are HELOCs and home equity loans. Both leverage the equity you have built up in your property. A bank or lender. Yes you can refinance it into a new HELOC with a better rate or into a home equity loan. But that's just generally speaking. Specifics depend on. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you. You may be able to refinance your home equity line of credit into a new HELOC, a fixed-rate home equity loan, a new mortgage, or a personal loan. Though refinancing a mortgage and taking out a home equity loan each offers a source of cash for homeowners, the similarities stop there. Make a big purchase. Buying a car, paying for a wedding, covering college expenses. Whatever you need it for, a cash-out refinance lets you use your home's. Refinancing a HELOC is similar to refinancing a first mortgage. You will have to qualify based on your income, expenses, debts, and home value. This means. For anyone considering a home refinance, I would highly refinancing your existing mortgage at the same time as obtaining a subordinate HELOC loan. There is no true VA home equity loan option. Veterans who want to access their home equity for cash should consider a VA cash-out refinance loan. The two common types of second mortgages are HELOCs and home equity loans. Both leverage the equity you have built up in your property. A bank or lender. Yes you can refinance it into a new HELOC with a better rate or into a home equity loan. But that's just generally speaking. Specifics depend on. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you. You may be able to refinance your home equity line of credit into a new HELOC, a fixed-rate home equity loan, a new mortgage, or a personal loan.

Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. Homeowners can refinance and HELOC at the same time if they want to refinance while taking cash out of their home. This is different from a cash-out. A HELOC allows you to take advantage of your home's equity. Your equity is the value of the home minus the amount you owe on the primary mortgage. Roll your HELOC into a mortgage refinance—Don't opt for this one without thoroughly researching the costs. Refinancing a first mortgage, and adding your HELOC. Yes, you can refinance a Home Equity Line of Credit (HELOC). There are several ways to achieve this: HELOC refinance options include refinancing to another. A home equity loan or cash-out refi comes with a fixed interest rate and monthly payment. A HELOC has a variable rate, but more flexibility as a credit. You can create flexibility through home equity refinancing. You might even consider refinancing into a home equity line of credit. Home equity is the current value of your home minus your outstanding mortgage balance. As you pay down your mortgage and/or your home appreciates in value, your. You can use our Versatile Line of Credit to finance or refinance your home and get a loan that's tied to your home equity line of credit. This tied loan works. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including. While getting a HELOC can require a credit score of up to , a refinance loan usually only requires a Some lenders will accept a score of The. You can get a home equity line of credit, also known as a "HELOC." You can get a cash out refinance, where you replace your current mortgage with a new. Comparing HELOC and Mortgage Refinance · HELOC: Offers more flexibility as you can draw funds as needed. · Refinance: Provides a one-time lump sum, which might be. Turn your home equity into cash with a HELOC loan. Access up to 90% or $k of your home equity. Apply for a HELOC loan with SoFi. Homeowners can refinance and HELOC at the same time if they want to refinance while taking cash out of their home. This is different from a cash-out. If you are seeking lenders to help you refinance your HELOC, you can always apply with our pre-screened refinance lenders to see if there is a loan product. The Figure Home Equity Line is an open-end product where the full loan amount (minus the origination fee) will be % drawn at the time of origination. The. To qualify for a HELOC loan, you will need to have at least 15% – 20% equity built up in your home. The lender will require an independent appraisal to assess. When refinancing your mortgage your new mortgage amount can not exceed 80% of the value of your property. For example, if you own a property appraised at.

How Do I Pay My Wayfair Bill

1. Shop at Wayfair. When you're ready to check out at Wayfair, just select Affirm as your payment method. Enter a few pieces of information and get a real-time. With Katapult Pay™, our one-time use virtual card, lease-purchasing is simpler than ever. Find Katapult Pay™ in the mobile app or download the Chrome. Billing & Payments · Payment Methods · Wayfair Credit Card · Promo Codes & Promotions · Payment Authorization Holds. How can I pay my Bread Rewards™ Card bill? + - Offer is exclusive to Bread Rewards™ American Express® Credit Card holders enrolled in the Bread Rewards. Log into your account to make a payment to your lease provider from the comfort of your home. At Bread Financial, we provide simple payment, lending and saving solutions. Explore our options for personal and business needs – from credit cards to. To receive 0% interest financing, simply pay with your Wayfair Credit Card and select the financing option at checkout. Subject to credit approval. See details. Choose the payment schedule that fits your needs. Icon. Purchase leased items within 90 days to save. Pay your Wayfair Credit Card (Comenity) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. 1. Shop at Wayfair. When you're ready to check out at Wayfair, just select Affirm as your payment method. Enter a few pieces of information and get a real-time. With Katapult Pay™, our one-time use virtual card, lease-purchasing is simpler than ever. Find Katapult Pay™ in the mobile app or download the Chrome. Billing & Payments · Payment Methods · Wayfair Credit Card · Promo Codes & Promotions · Payment Authorization Holds. How can I pay my Bread Rewards™ Card bill? + - Offer is exclusive to Bread Rewards™ American Express® Credit Card holders enrolled in the Bread Rewards. Log into your account to make a payment to your lease provider from the comfort of your home. At Bread Financial, we provide simple payment, lending and saving solutions. Explore our options for personal and business needs – from credit cards to. To receive 0% interest financing, simply pay with your Wayfair Credit Card and select the financing option at checkout. Subject to credit approval. See details. Choose the payment schedule that fits your needs. Icon. Purchase leased items within 90 days to save. Pay your Wayfair Credit Card (Comenity) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple.

How can I pay my bill? You can make a payment through your online account anytime. Here's how: Choose your payment amount, then select your bank account. ESTIMATE YOUR MONTHLY PAYMENTS. Make the best decision on how to budget your purchase with our convenient Payment Calculator. Start Calculating. FAQ. To pay your MetroPCS bill you can either go to a MetroPCS store location and pay in person, or you can pay your bill online with a credit or debit card on the. Pay your Wayfair Credit Card bill in seconds! Pay now or schedule it for later, online or from any mobile device. Payments on doxo are fast, easy, and safe. To make an immediate payment, call Wayfair credit services at You can access your account through the automated system using your account number. Tap or click Make a payment. Choose the payment amount, payment date, and payment method. How do I pay my bill or manage my account? Click here to pay your Citibank, N.A. Birch Lane Credit Card or Birch Lane Mastercard bill online or change your. My husband and I just moved and are trying to find an affordable couch. Our plan is to finance a couch and then pay it off as soon as we get. How can I pay my bill? You can make a payment through your online account anytime. Here's how: Choose your payment amount, then select your bank account. If you'd prefer to pay by check or money order, we are happy to accept them. (For more information, see below). What Are My Payment Options? Credit Cards. We. Home/ · Help Center/ · Payment-options-hhtml. This excludes Mattress Toppers, Crib Mattresses, Air Mattresses, and Open Box Mattresses. Some payment methods (e.g. financing payment options) might not be. Merchant is paid directly from Citizens Pay. Risk-proof. Citizens Pay assumes all repayment and fraud risk while providing best-in-class servicing. All I need to do is log into my account and pay a bill!!!!! Upvote 1 Can someone please tell me how to add my Wayfair Credit Card to Wayfair?? Pay over time with Wayfair Financing. We provide financing and leasing options through Affirm, Katapult and Acima. Check your eligibility! But they lie, Wayfair credit card is another greedy corporation. I was a few days late paying my bill and they still charged me a late fee which is almost. Amica offers billing and payment options that are most convenient for you. Learn how you can manage your policy online with e-billing. The amount you must pay each billing period ("Total Minimum Payment") is the total of minimum payments for Regular. Revolving and promotional Credit Plan. ESTIMATE YOUR MONTHLY PAYMENTS. Make the best decision on how to budget your purchase with our convenient Payment Calculator. Start Calculating. FAQ.

15 Year Arm Calculator

lechgmr.ru provides FREE adjustable rate mortgage calculators and other ARM calculator tools to help consumers decide if an ARM or fixed rate mortgage is. calculate adjustable-rate mortgage (ARM) interest rates. more · Annual ARM Cap adjustable-rate mortgage's (ARM) interest rate during each year. more. The adjustable rate mortgage (ARM) calculator helps calculate what your monthly payments may be with an arm loan from U.S. Bank. (Borrowers are seeking ways to reduce their periodic payments.) And some lenders issued loans fifteen or twenty years ago that are near maturity for which the. Term in years. The number of years over which you will repay this loan. Common fixed-rate mortgage terms are 15, 20 and 30 years. Expected adjustment. The. 7/1 ARM Calculator. This calculator will help you determine what your rates with a 15 or 30 year fixed rate mortgage. The potential for the loan. Use our adjustable rate mortgage (ARM) calculator to see how interest rate assumptions will impact your monthly payments and the total interest paid over the. Use this calculator to compare a fixed-rate mortgage to a Fully Amortizing ARM Common fixed-rate mortgage terms are 15, 20 and 30 years. Expected. This calculator will help you to determine what your estimated adjustable rate mortgage payments will be for a range of interest rates. lechgmr.ru provides FREE adjustable rate mortgage calculators and other ARM calculator tools to help consumers decide if an ARM or fixed rate mortgage is. calculate adjustable-rate mortgage (ARM) interest rates. more · Annual ARM Cap adjustable-rate mortgage's (ARM) interest rate during each year. more. The adjustable rate mortgage (ARM) calculator helps calculate what your monthly payments may be with an arm loan from U.S. Bank. (Borrowers are seeking ways to reduce their periodic payments.) And some lenders issued loans fifteen or twenty years ago that are near maturity for which the. Term in years. The number of years over which you will repay this loan. Common fixed-rate mortgage terms are 15, 20 and 30 years. Expected adjustment. The. 7/1 ARM Calculator. This calculator will help you determine what your rates with a 15 or 30 year fixed rate mortgage. The potential for the loan. Use our adjustable rate mortgage (ARM) calculator to see how interest rate assumptions will impact your monthly payments and the total interest paid over the. Use this calculator to compare a fixed-rate mortgage to a Fully Amortizing ARM Common fixed-rate mortgage terms are 15, 20 and 30 years. Expected. This calculator will help you to determine what your estimated adjustable rate mortgage payments will be for a range of interest rates.

The most common mortgage terms are 15 years and 30 years. Current index. The current interest rate of the index used to calculate the interest rate on this. For example, in a 5y/6m ARM, the 5y stands for an initial 5-year period ARM interest rates and payments are subject to increase after the initial fixed. Mortgage loan term: 30 years, 25 years, 20 years, 15 years, 12 years, 10 years, 5 years. Adjustments. Number of months before first rate adjustment: Number of. Anyone with a traditional fixed-rate mortgage with a year or year term can consider refinancing into a 5/1 adjustable-rate mortgage program. This could be. Adjustable Rate Mortgage Calculator. Thinking of getting a variable rate loan? Use this calculator to figure your expected monthly payments — before and. ARM Mortgage Calculator – Adjustable Rate Mortgage. Loan Information. Mortgage amount: Mortgage loan term: 30 years, 25 years, 20 years, 15 years, 12 years, More Mortgage Calculators. Monthly Payment Calculator · How Much House Can I Afford? Refinance Break Even Calculator · 30 to 15 Year Refinance Calculator · The number of years over which you will repay this loan. Common fixed-rate mortgage terms are 15, 20 and 30 years. Expected adjustment. The annual adjustment. The payment is calculated to payoff the mortgage balance at the end of the term. The most common terms are 15 years and 30 years. Fully Amortizing ARM. This is. Mortgages, with fixed repayment terms of up to 30 years (sometimes more) are fully-amortizing loans, even if they have adjustable rates. Revolving loans. The adjustable rate mortgage calculator will help you to determine what your monthly mortgage payments will be on an adjustable rate mortgage. At the end of the 15th year, the interest rate adjustment will be no more than 6% up or down with a floor rate of % and a maximum rate of 18%. The adjusted. Interest Only ARM Mortgage Options. ARM Type, Months Fixed. 30 year fixed, Interest only payments at a fixed rate for 15 years. After 15 years, the loan is. Calculate your mortgage payment for an adjustable-rate mortgage (ARM). This Years to 1st adjustment? 3. Adjustment period? 1. Monthly Mortgage Calculator. Loan Amount: Interest rate: Years. Some 5/1 ARMs may be amortized over 30 years, while others may have a shorter amortization period of 25 or 15 years. How do you calculate ARM rate? To. As of April , the market average interest on a year plan was %, according to Freddie Mac. However, since the year amortization schedule is on a. Common fixed-rate mortgage terms are and year mortgages. A year fixed-rate mortgage is considered a long-term mortgage and often offers some of. Moreover, shorter fixed-rate terms usually come with lower interest rates than longer terms. A year fixed mortgage rate is typically lower by % to 1%. Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the.

Selling House On Your Own

Selling your house yourself can save you money on a seller's commission. However, you will still have to pay for several items to get your house on the market. We instead will make you a serious cash offer to buy your house using our own money. In most cases, these homeowners need to sell their house fast and we are. To easily sell your home for sale by owner is to have it listed on Zillow. Zillow is the #1 search engine used to search for homes in the U.S. Paperwork for selling a house by owner · Original sales contract. This is paperwork from when you purchased the home. · Property survey. · Mortgage statement and. Hi - For Sale by Owners FSBO's - statistically sell for about 24% less than w a Realtor - so even with paying Commission a seller will net less. The only way to sell your house online for free (without paying any kind of commission or marketing fees) is to find a buyer who isn't working with an agent. Deciding to sell your home yourself is referred to as for-sale-by-owner (FSBO). The FSBO process is similar to traditional selling, but without the help of a. The Cost Of Selling A Home As Is By Owner (FSBO) Making a choice to sell your own home on your own as is, can drive up the profit by saving a real estate. But selling your house for sale by owner (FSBO) doesn't guarantee savings. Selling FSBO also isn't the only way to save money when selling a home, nor is it the. Selling your house yourself can save you money on a seller's commission. However, you will still have to pay for several items to get your house on the market. We instead will make you a serious cash offer to buy your house using our own money. In most cases, these homeowners need to sell their house fast and we are. To easily sell your home for sale by owner is to have it listed on Zillow. Zillow is the #1 search engine used to search for homes in the U.S. Paperwork for selling a house by owner · Original sales contract. This is paperwork from when you purchased the home. · Property survey. · Mortgage statement and. Hi - For Sale by Owners FSBO's - statistically sell for about 24% less than w a Realtor - so even with paying Commission a seller will net less. The only way to sell your house online for free (without paying any kind of commission or marketing fees) is to find a buyer who isn't working with an agent. Deciding to sell your home yourself is referred to as for-sale-by-owner (FSBO). The FSBO process is similar to traditional selling, but without the help of a. The Cost Of Selling A Home As Is By Owner (FSBO) Making a choice to sell your own home on your own as is, can drive up the profit by saving a real estate. But selling your house for sale by owner (FSBO) doesn't guarantee savings. Selling FSBO also isn't the only way to save money when selling a home, nor is it the.

Compare the savings you'll get with a discount broker to the potential savings of selling FSBO, or read on for more about managing your own sale and FSBO. Taking the First Steps · Step 1 Clean out your home. · Step 2 Have your property evaluated · Step 3 Have your home inspected. Don't Ask for More Than Your Home is Worth When residential real estate inventory is low, the market is hot for sellers. But that doesn't mean buyers will. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. There are many sites available for home listing. Zillow, Trulia, FSBO, HomeFinder and lechgmr.ru are all popular options for easy listing by owner. Some. 1. Determine a price · 2. Prepare and take photos · 3. List your home without a realtor · 4. Make the sale without a realtor · The pros and cons of selling a house. Important Steps in Your Home Selling Journey · Learn the market and determine your home's value: Do a little research so you're familiar with your market; it. However, listing your house as “for sale by owner” (FSBO) means you won't need to pay extra commission to a real estate agent — 6% of the selling price is. Selling your house on your own is time consuming and potentially stressful. You will have to place ads on your own, schedule tours, personally negotiate, and. "For sale by owner" (FSBO) indicates that a property is available for purchase directly from the owner rather than through a real estate agent or broker. Get Ready to Sell Your House · couple with for sale sign in front of home · 1) Decide if you want to do a FSBO ("For Sale By Owner") or use a real estate agent. If you have time on your hands to show your home, advertise it, and negotiate with potential buyers, you might be able to sell your home on your own. If you're. Paying a commission can take a big chunk out of your profits, so it may make sense for some people to handle the sale on their own. This is particularly true if. Taking yourself out of your house allows the prospective buyer to imagine themselves living in your house and making it theirs. For example, your kids' baby. An overview of your legal requirements when selling a home in California. · California Home Sellers Must Disclose All Facts That Could Affect the Desirability of. Selling your house on your own is time consuming and potentially stressful. You will have to place ads on your own, schedule tours, personally negotiate, and. You are technically a For Sale By Owner seller (FSBO). You should start thinking about how your home will be marketed if you're not using a Realtor. There are. Another advantage to FSBO is scheduling showings. For a seller who needs to show the home on their schedule, it's much easier to manage your own timeline rather. Option 2: Sell Your House Online Without a Real Estate Agent When you sell your home without an agent, it's often called for-sale-by-owner, or FSBO. If you. Learn how to sell your home using agent pairing technology that connects you with agents in real-time.

How To Work Out Car Finance

How does the car finance calculator work? · Choose your monthly budget or the amount you want to borrow · Select how many years you want to borrow this amount for. Work Out Your Car Loan Repayments. Use our car loan calculator to estimate what your monthly repayments could be. Your loan details. Loan amount. Vehicle. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other. How to Calculate Auto Loan Interest for the Coming Months · Subtract the interest from your current debt. The amount left is what you owe towards your loan. Long-term auto loans offer higher interest rates, and the longer the car loan, the more interest you'll pay overall. Larger down payments can reduce both your. On the hunt for a new car? Use our handy car finance calculator to work out how much you might pay each month on our Personal Contract Purchase (PCP) or Hire. Use our car loan calculator to help you work out how much your monthly payments will be or what you'll be able to afford to borrow, whether you are buying. Shop around for a lower interest rate. When you take out an auto loan, you'll be assigned an interest rate that represents the cost to borrow money to pay for. Estimate your monthly payments with lechgmr.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. How does the car finance calculator work? · Choose your monthly budget or the amount you want to borrow · Select how many years you want to borrow this amount for. Work Out Your Car Loan Repayments. Use our car loan calculator to estimate what your monthly repayments could be. Your loan details. Loan amount. Vehicle. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other. How to Calculate Auto Loan Interest for the Coming Months · Subtract the interest from your current debt. The amount left is what you owe towards your loan. Long-term auto loans offer higher interest rates, and the longer the car loan, the more interest you'll pay overall. Larger down payments can reduce both your. On the hunt for a new car? Use our handy car finance calculator to work out how much you might pay each month on our Personal Contract Purchase (PCP) or Hire. Use our car loan calculator to help you work out how much your monthly payments will be or what you'll be able to afford to borrow, whether you are buying. Shop around for a lower interest rate. When you take out an auto loan, you'll be assigned an interest rate that represents the cost to borrow money to pay for. Estimate your monthly payments with lechgmr.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

How to use the formula for APR calculation · Calculate the interest rate. · Add the administrative fees to the interest amount. · Divide by the loan amount . Hire Purchase: The calculator will work out your regular monthly payments for the entire term of the deal. With hire purchase once the final payment has been. The easy online car finance payment calculator at Mercedes-Benz of North Olmsted can help you find a payment plan that fits comfortably within your price point. Find an agent. Your location is set for,. Edit location. select a product to out of targeted online advertising” button below. Please note that this. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Loan amount, loan term, and interest rate all factor into the calculation. Loan amount is determined by the size of your down payment, any applicable rebates. When you take out a car loan from a financial institution, you receive your money in a lump sum, then pay it back (plus interest) over time. Quickly find out how much you can borrow and your monthly repayments using our car finance calculator. Securely apply for a car loan online today! Save with lower interest rates when you finance or refinance your vehicle loan with Mountain America Credit Union. HelpFind a branchSchedule an appointment. Shopping around and getting loan estimates from several lenders can help you find a loan that fits your budget. While getting financing through a dealership can. How to calculate interest on a car loan · Calculate the monthly payment using the monthly payment formula. · Multiply the monthly payment by the number of months. To obtain financing, the financial service provider will check your credit report and credit score. If your credit score is high, you'll have a higher. To find out what you could pay each month, enter the full price of the new car, the deposit and how long you want to borrow for. The calculator also shows what. If you're looking to finance a car, you can use our free online car finance calculator to find out how much your PCP, HP or loan repayments could be. Can't find what you need? Please type a search query and we'll try to help. First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees. The majority of people who buy cars finance them, as most don't have the flexibility or desire to pay cash. These loans work out just fine in most instances. Interest on a car loan is often front-loaded so early payments pay more toward interest and less toward the principal loan balance. · A longer-term loan can. Calculating Car Loan Interest · Total interest payment = Loan amount (outstanding balance) x (interest rate / number of payments per year) · Outstanding balance.

Fast Loan Advance Reviews

The advance fee, no matter what the reason for it, is the #1 sign of a loan scam. A legitimate lender would take the money out of what he's set apart to loan. A cash advance is a short-term loan from a bank or an alternative lender. In an extreme situation, a cash advance is fast and accessible; just make. Fast Loan Advance is a platform for subprime borrowers with poor to fair credit. If you do not know your credit score, we recommend visiting AnnualCreditReport. loans. With a line of credit, get unlimited cash advances, up to your credit limit, without having to reapply. Apply for a personal loan online today. Fast Loan Advance can be a legitimate option for obtaining quick cash in an emergency, but it's crucial to weigh the pros and cons carefully. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. This organization is not BBB accredited. Loans in Atlanta, GA. See BBB rating, reviews, complaints, & more. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. This organization is not BBB accredited. Payday Loans in Westchester, IL. See BBB rating, reviews, complaints, & more. The advance fee, no matter what the reason for it, is the #1 sign of a loan scam. A legitimate lender would take the money out of what he's set apart to loan. A cash advance is a short-term loan from a bank or an alternative lender. In an extreme situation, a cash advance is fast and accessible; just make. Fast Loan Advance is a platform for subprime borrowers with poor to fair credit. If you do not know your credit score, we recommend visiting AnnualCreditReport. loans. With a line of credit, get unlimited cash advances, up to your credit limit, without having to reapply. Apply for a personal loan online today. Fast Loan Advance can be a legitimate option for obtaining quick cash in an emergency, but it's crucial to weigh the pros and cons carefully. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. This organization is not BBB accredited. Loans in Atlanta, GA. See BBB rating, reviews, complaints, & more. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. This organization is not BBB accredited. Payday Loans in Westchester, IL. See BBB rating, reviews, complaints, & more.

14 people have already reviewed Fast Loan Advance. Read about their experiences and share your own!

Please come here before going to a corporate loan service, after shopping around I found Fast Payday Loans has the most favorable terms for the customer! You. for you to get money fast with more freedom. Apply online and get loan up to $ from Advance Financial. If you're looking for a quick and easy way to get a loan, Fast Loan Advance might be a good choice. My experience with them was positive, and I hope yours will. 21 people have already reviewed Fast Loan Advance. Read about their experiences and share your own! While some users appreciate the quick access to funds in emergencies, others criticize the high fees and short repayment terms. It's essential. Fast Loan Advance is a platform for subprime borrowers with poor to fair credit. If you do not know your credit score, we recommend visiting AnnualCreditReport. A smarter alternative to a payday lender. With eligibility based on your income, not your credit score. I applied and was approved for $ I paid the bi-weekly payments until it was paid off. I was approved again for $, same with that, I paid the loan. Simple Fast Loans Makes Getting a Loan Easy! Looking for a fast loan advance to cover unexpected expenses? Simple Fast Loans has you covered with online. trustpilot logo. out of 5 based on , reviews. review icon ,+ reviews on Google. Getting a loan is fast and easy. 1. Start your application. Get ready to finance your cash needs with an instant money loan. This is a fair and convenient way to obtain an instant payday advance. Recommended Reviews - Fast Loans. Your trust is our top concern, so Payday Advance in Los Angeles · Check Cashing in Los Angeles · Banks & Credit. Simple Fast Loans. lechgmr.ru•13K reviews. · Everyday Loans. www Payday Advance Reviews. 73 • Excellent. VERIFIED COMPANY. In the Loan Agency. DailyPay is another type of EWA, where you're receiving money you've already earned, rather than waiting until payday to access your money. This is helpful if. Customer Reviews · Search Payday Loans are also commonly referred to as Cash Advances, Payday Advances, Payday Advance Loans, and Fast Cash Loans. Klover - Instant Cash Advance 4+ · Up to $ Before Payday · Klover Holdings, Inc. · iPhone Screenshots · Description · What's New · Ratings and Reviews · App Privacy. Small business owners looking for fast working capital may want to consider 1West Finance. The lending marketplace offers various small business loan. What documents do I need for fast business finance? Applying for a quick business loan is typically straightforward. Most lenders will require the following. Quick loan alternatives · Credit card cash advance · Paycheck advance app · Friends and family · Hardship programs. When an emergency arises, it's crucial to have quick access to cash. Avoid the predatory nature of payday loans with an alternative option from SECU. Apply now.

What Is The Zestimate Price Mean

However, the Zestimate is not an estimate of what you might sell the house for, it's an estimate of the house's worth. It can't take the human. To craft a Zestimate, Zillow uses a fancy formula it came up with that churns out a home price based on real estate information from several forms of data. The Zestimate home valuation model is Zillow's estimate of a home's market value. The Zestimate incorporates public and user-submitted data. According to Zillow, “the vast majority of Zestimates are within 10 percent of the selling price of the home.” These estimates are only as accurate as the. The Zillow Zestimate, and other Automated Valuation Models (AVM's) like it attempt to provide a useful estimate of a home's current value. Since the actual draws of buyer valuations are not affected by the beliefs about the true value, a higher reservation price will imply that the property is less. A Zestimate is Zillow's attempt to use algorithms and publicly available data points that influence housing prices to estimate a home's value at any given time. This is the percentage of transactions in a location for which the Zestimate was within 20% of the transaction lechgmr.rually, Zestimates are currently within. The Zestimate (btw do you guys pronounce that as "Zest-e-met" or "Z-estimate?) Is what we'd call an automated valuation model. It's looking at. However, the Zestimate is not an estimate of what you might sell the house for, it's an estimate of the house's worth. It can't take the human. To craft a Zestimate, Zillow uses a fancy formula it came up with that churns out a home price based on real estate information from several forms of data. The Zestimate home valuation model is Zillow's estimate of a home's market value. The Zestimate incorporates public and user-submitted data. According to Zillow, “the vast majority of Zestimates are within 10 percent of the selling price of the home.” These estimates are only as accurate as the. The Zillow Zestimate, and other Automated Valuation Models (AVM's) like it attempt to provide a useful estimate of a home's current value. Since the actual draws of buyer valuations are not affected by the beliefs about the true value, a higher reservation price will imply that the property is less. A Zestimate is Zillow's attempt to use algorithms and publicly available data points that influence housing prices to estimate a home's value at any given time. This is the percentage of transactions in a location for which the Zestimate was within 20% of the transaction lechgmr.rually, Zestimates are currently within. The Zestimate (btw do you guys pronounce that as "Zest-e-met" or "Z-estimate?) Is what we'd call an automated valuation model. It's looking at.

When you sell your home, the buyer's lender will typically require an appraisal to confirm that the sale price is aligned with your home's market value. This is the percentage of transactions in a location for which the Zestimate was within 20% of the transaction lechgmr.rually, Zestimates are currently within. Provides Zestimates (home valuations based on computer algorithms); Allows potential Buyers to connect with a property's listing agent and up to three other. The Zestimate is intended to provide an estimate of the price that a home would fetch if sold for its full value, where the sale isn't for partial ownership. It is a computer generated value based on basic characteristics of your home (house style, size, bedrooms, bathrooms etc.) and the total taxes the town need to. The Zestimate home valuation model is Zillow's estimate of a home's market value. The Zestimate incorporates public and user-submitted data. Zillow Group, Inc., or simply Zillow, is an American tech real-estate marketplace company that was founded in by co-executive chairmen Rich Barton and. In Los Angeles, its Zestimates are within 5% of the actual sales price % of the time. That means that if Zillow says a listed house in Los. Here's an example: Imagine a neighborhood of year old houses. If a house that hasn't been updated sells, Zillow factors that sale price. If your look up your home's value on Zillow's valuation tool, Zestimate®, you may feel strongly impacted by the price that comes up. It may not be accurate. They also indicate on their site that their Zestimates are within 20% of the sales price % of the time. It's important to note that 20 percent of a home's. Zestimate® is a home valuation model created by the real estate listing service Zillow that estimates the market value of a property. Zillow has developed a. I know Zillow does a lot more to calculate the Zestimate but it is useful to think of a simple calculation: Average price per square foot. Zestimates tell you something. They're starting points of information, and they can help shed light on to the values of homes. However, they're not as accurate. In my metro area, Raleigh, 85% of listings sold within 5% of the Zestimate. The median home in Raleigh sold for $,, so that means the Zestimate would have. When you sell your home, the buyer's lender will typically require an appraisal to confirm that the sale price is aligned with your home's market value. Price. Speak With A Realtor › Understanding MLS Listing Terms What Does Pending On Zillow Mean? If you are searching for a new house. Zillow Showcase is an immersive experience with bigger photos, interactive floor plans, and more branding for listing agents to help your listings shine. According to Zillow, the Zestimate has a nationwide median error rate for homes on the market of %. This means that the Zestimates for half of all on. Zillow has a median error rate of % for active listings. That means the Zestimate will be within % of the sales price for half of all its on-market.

Tell Me About Stock Market

A stock exchange is simply a marketplace where traders buy and sell stocks. (Some other types of investments—like exchange-traded funds (ETFs) and notes (ETNs). With Google Nest or Home speaker or display, you can get information on your individual stocks and portfolio, as well as stay on top of the global market. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Reconciling management and market expectations, particularly when there are significant disparities between the two, is essential for corporate decisions on the. “5 things to know before the stock market opens” is a daily look at the most important news, trends and analysis that investors need to start their trading. From breaking news about the stock market today, to retirement planning for tomorrow, follow The Motley Fool Canada for investing advice. The New York Stock Exchange traces its origins to the Buttonwood Agreement signed by 24 stockbrokers on May 17, , as a response to the first financial. Stock Market News - MarketWatch offers all the latest stock market news and currencies market news. Find the latest Tellurian Inc. (TELL) stock quote, history, news and other vital information to help you with your stock trading and investing. A stock exchange is simply a marketplace where traders buy and sell stocks. (Some other types of investments—like exchange-traded funds (ETFs) and notes (ETNs). With Google Nest or Home speaker or display, you can get information on your individual stocks and portfolio, as well as stay on top of the global market. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Reconciling management and market expectations, particularly when there are significant disparities between the two, is essential for corporate decisions on the. “5 things to know before the stock market opens” is a daily look at the most important news, trends and analysis that investors need to start their trading. From breaking news about the stock market today, to retirement planning for tomorrow, follow The Motley Fool Canada for investing advice. The New York Stock Exchange traces its origins to the Buttonwood Agreement signed by 24 stockbrokers on May 17, , as a response to the first financial. Stock Market News - MarketWatch offers all the latest stock market news and currencies market news. Find the latest Tellurian Inc. (TELL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Stocks are bought and sold on a stock exchange such as the New York Stock Exchange (NYSE) and in the private market, where individual and institutional. Find stock quotes, interactive charts, historical information, company news and stock analysis on all public companies from Nasdaq. Join the millions of people using the lechgmr.ru app every day to stay on top of the stock market and global financial markets! You can do a quick check on free stock market quote services, such as: Big tell you if a company has relocated. The presence of a stock certificate. It features detailed market data—including company profiles, key ratios and valuation information—and trading data on a wide range of stocks. Another way to. It tells you momentum is halting. On weekly charts, look for weeks Stock Market Today · The Big Picture · Economic Calendar · Investing Workshops · New. Sector performance was broad, as consumer discretionary and industrial stocks led to the upside. Bond yields edged higher, with the year Treasury yield at. TELL | Complete Tellurian Inc. stock news by MarketWatch. View real Virtual Stock Exchange · Video · MarketWatch 25 Years · SectorWatch · The Moneyist. Companies list on the stock market to raise capital by by selling their shares to institutional or retail investors. Institutional investors means entities like. The stock market offers investors liquidity by providing an easy-to-use platform for buying and selling stocks. Since it enables investors to quickly turn their. Today's market ; NYSE COMPOSITE INDEX, 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Only time will tell whether companies will reap the benefits of their investments, but for now the perception is that the missed opportunities for. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Analyze stocks in seconds w/proprietary indicators. Free quick start course & investment coaching. Market timing gauge tells you when you get in/out. Find the latest stock market news from every corner of the globe at lechgmr.ru, your online source for breaking international market and finance news. Biden and Xi to speak after rare U.S. security advisor trip to China. Thu Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. People will often refer to one of the major stock market indexes, like the Dow Jones Industrial Average or the S&P when they talk about the stock market. When it comes to investing in the stock market, there's no such thing as the perfect approach. Each investor is unique and has their own investment style based. Trading in most stocks takes place without interruption throughout the day—but sometimes a stock may be subject to a short-term trading halt, trading delay or.

Kia 7 Year Warranty

10 YEARS. , MILES. Cars Built To Last. Warranties Too. We have a lot of confidence in the quality and durability of every new Kia that rolls off the. The extended protection of the Kia year/,mile warranty program gives Kia vehicle owners an added safeguard against unforeseen service and repairs. You. Kia covers components of hybrid and electric cars for an unlimited mileage up to 36 months, and then up to , miles between 37 and 84 months. On your EV. The Kia year/,mile warranty program* covers repairs made to precise Kia standards and requirements. You can rest easy knowing your vehicle is in the. In my country the 7 year warranty applies only for gearbox and engine. And only if you made all services in Kia dealerships, otherwise the. Who really offers America's best warranty? Kia matches Hyundai's coverage with a year/mile powertrain warranty, a 5-year/mile basic warranty. The Kia year/, mile warranty program consists of: • year/, mile limited powertrain warranty. • 5-year/60, mile limited basic warranty. The Kia year/mile warranty program delivers exceptional coverage to keep you protected on the roads of Jackson. The warranty period for all current models is months/unlimited mileage. The warranty period begins from the date of first registration and it's transferable. 10 YEARS. , MILES. Cars Built To Last. Warranties Too. We have a lot of confidence in the quality and durability of every new Kia that rolls off the. The extended protection of the Kia year/,mile warranty program gives Kia vehicle owners an added safeguard against unforeseen service and repairs. You. Kia covers components of hybrid and electric cars for an unlimited mileage up to 36 months, and then up to , miles between 37 and 84 months. On your EV. The Kia year/,mile warranty program* covers repairs made to precise Kia standards and requirements. You can rest easy knowing your vehicle is in the. In my country the 7 year warranty applies only for gearbox and engine. And only if you made all services in Kia dealerships, otherwise the. Who really offers America's best warranty? Kia matches Hyundai's coverage with a year/mile powertrain warranty, a 5-year/mile basic warranty. The Kia year/, mile warranty program consists of: • year/, mile limited powertrain warranty. • 5-year/60, mile limited basic warranty. The Kia year/mile warranty program delivers exceptional coverage to keep you protected on the roads of Jackson. The warranty period for all current models is months/unlimited mileage. The warranty period begins from the date of first registration and it's transferable.

The Kia warranty is a comprehensive warranty that covers your car for up to 10 years or miles, whichever comes first. Learn about extended options at. The Kia new car warranty consists of year/,mile powertrain coverage, 5-year/60,mile basic warranty coverage, and more. With the Kia warranty. For complete details, see a dealer or download complete details of Kia year/,mile warranty program in PDF format. Toll-Free Assistance: 24/7 just call. Your Kia Electrified Vehicle and its battery is covered by a 7-year warranty. Whether it's a “self-charging” hybrid (HEV), plug-in hybrid (PHEV) or a fully. In the US, the Powertrain (engine & transmission) have a 10 year warranty, while the majority of the rest of the car is 5 years. Kia covers the components of a new Kia car for unlimited mileage up to 36 months, and then , miles between 37 months and 84 months. However. CARS BUILT TO LAST. WARRANTIES TOO. · Peace of Mind. The extended protection of the Kia year/,mile warranty program* gives Kia owners added peace of. Ten-year/,mile limited powertrain warranty. Kia calls their year/,mile warranty a testament to the quality of their vehicles. This program. Our standard 7-year warranty gives you just as much coverage, if not more, than other extended car warranties. It's just one of the great benefits of the Kia. New Kia Warranty · Kia's legendary 10 year, , mile warranty. Kia has a lot of pride in the vehicles they build, and here at the Kia Store, we're proud to. Kia warranty lasts for seven years, or ,km. With the longest standard manufacturer warranty in Europe, you can enjoy complete peace of mind. is Kia's 7 year warranty that reliable? Hello, european here. Looking to buy a Kia Stonic so, is kia's famous 7 year warranty that solid as they. Peace of mind. Kia warranty lasts for seven years, or ,km. With the longest standard manufacturer warranty in Europe, you can enjoy complete peace of mind. The 7-year or ,mile warranty is covered on all Kia models, with no hidden agendas. You can even pass on your warranty if you decide to resell it, which. Not only will you have a limited 5-year/60,mile Kia bumper-to-bumper warranty that covers most parts and accessories, but the year/,mile Kia. The year/,mile limited powertrain warranty changes to a 5-year/60,mile limited powertrain warranty when the vehicle is sold. 7 days a week. This means that if something goes wrong with your Kia, whether it's a faulty transmission or a door that won't open, you're covered for 7 years or , miles. Kia vehicles are built to last. So are our warranties. 10 years. miles. Learn more about the Kia Warranty now! the KIA New Vehicle Warranty for a period of 7 years. For Commercial Use Vehicles, this warranty coverage is for 7 years or , km, whichever occurs first. year/,mile limited Kia powertrain warranty; 5-year/60,mile Kia Telluride thanks to more than 17, roadside assistance providers available 24/7.

What Can You Do With Equity In Your Home

DO use home equity for improvements or additions that add value to your home. Ideally, it is an asset and should be used for other assets. A home equity loan. Consolidate high-interest debt using home equity financing · Borrow what you need, as you need it, up to your credit limit ; Renovate your home using home equity. Home equity is the current sale price minus what you owe. You can increase your home equity by paying off your mortgage. Or by the house. If you're a homeowner in need of credit, borrowing against your home's equity can be a great option. A home equity loan and a home equity line of credit. Typically given as a one-time lump sum, this type of loan is secured against the value of your home equity. Home equity loan interest rates are usually fixed. But if you can't repay the financing, you could lose your home and any equity you've built up. If you can't make the payments, you could end up losing your. A home equity loan essentially allows you to use your original home as collateral, this time to purchase a second property. Home equity loans are generally a good choice if you know exactly how much you need to borrow and for what. You're guaranteed a certain amount, which you. The 6 best ways to use home equity · Home improvements · Real estate investing · Higher education expenses · See home equity rates for your home · Medical expenses. DO use home equity for improvements or additions that add value to your home. Ideally, it is an asset and should be used for other assets. A home equity loan. Consolidate high-interest debt using home equity financing · Borrow what you need, as you need it, up to your credit limit ; Renovate your home using home equity. Home equity is the current sale price minus what you owe. You can increase your home equity by paying off your mortgage. Or by the house. If you're a homeowner in need of credit, borrowing against your home's equity can be a great option. A home equity loan and a home equity line of credit. Typically given as a one-time lump sum, this type of loan is secured against the value of your home equity. Home equity loan interest rates are usually fixed. But if you can't repay the financing, you could lose your home and any equity you've built up. If you can't make the payments, you could end up losing your. A home equity loan essentially allows you to use your original home as collateral, this time to purchase a second property. Home equity loans are generally a good choice if you know exactly how much you need to borrow and for what. You're guaranteed a certain amount, which you. The 6 best ways to use home equity · Home improvements · Real estate investing · Higher education expenses · See home equity rates for your home · Medical expenses.

If you own your home chances are you've built up some equity. You can borrow against equity to buy an investment property, renovate or achieve other goals. Depending on how much equity you have, you can take cash out and use it to consolidate high-interest debt, pay for home improvements, or pay for college. How Do. HELOC for Self Employed: What to Know. A HELOC for self employed individuals lets you borrow money using equity in your home as collateral. Home Improvement. Building home equity takes time, and it can be done in several ways. For example, making regular mortgage payments and gradually reducing the principal owed. Your home's equity can be used for many things including home additions, debt consolidation, adoption expenses, or even an extravagant vacation. Building equity in your home happens as you repay your mortgage loan. Every time you make your monthly payment, you pay interest plus a small portion of the. A home equity loan lets you borrow money against the value of your home's equity to pay for things like home renovations and college educations. If you've used up the cash in your emergency fund, you could draw on a HELOC to pay for house repairs, medical bills or other unexpected costs. Help pay for. Your home is your castle, but it also can be turned into a liquid asset when you need money. You build equity in your home as you pay your mortgage down, and. Consider using your equity. You can leverage your home's equity to make improvements to your property, which not only helps you save on remodeling costs but can. How to use home equity: 5 smart things you can do · 1. Put it back into your home · 2. Consolidate debt · 3. Approaching or living in retirement · 4. Whatever comes. The best use of home equity is to keep you out of debt. Keep it in your house. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. A home equity loan is a great way to turn the equity you hold in your property into ready cash, but it does come with some long-term consequences for your home. Home improvements: One of the best uses of home equity funds is for home improvements. · Debt consolidation: If you have high-interest debt, like credit card. Fund my project, how to use home equity. There are three main ways for how you can use your home equity: a loan, a line of credit and refinancing. But remember: The stakes are higher with a home equity loan because it's secured by your home. If you can't make your payments, the lender could foreclose on. If you have owned your home for a few years, the equity in your home may be your largest asset. Educate yourself before you pledge your equity for a loan or. You build equity in two ways: by paying down your mortgage over time and through your home's appreciation. 1. Paying your mortgage. Each month, you will make. Similar in structure to your primary mortgage, this option could make sense if you don't want to refinance that loan. With a home equity loan, you borrow.

1 2 3 4 5 6