lechgmr.ru Prices

Prices

Training For Sales Reps

Janek's award-winning sales training programs deliver lasting behavioral change to improve sales performance long-term. Understanding these cyclical swings can help salespeople plan and design a better process for any industry. With proper training, a sales professional will. Online Sales Excellence Training This online interactive training is built for experienced reps who are looking to up their skills and boost their sales. Changes in technology, legislation, customer needs, all serve to make you and your business less relevant unless you change with them. Salespeople form a vital. Create a sales vision. Develop strategies to achieve goals. Improve their decision-making skills; Understand the six factors that motivate sales reps; Improve. Sales training helps salespeople build relationships, enhance communication skills, gain knowledge, boost productivity, and ultimately sell more products and. Through Dale Carnegie's sales training courses, you'll learn to generate more leads, resulting in increased sales performance. A unique set of skills and a sales methodology that any sales rep can learn. And while you can learn the basics by reading The Challenger Sale, our professional. Through Dale Carnegie's sales training courses, you'll learn to generate more leads, resulting in increased sales performance. Janek's award-winning sales training programs deliver lasting behavioral change to improve sales performance long-term. Understanding these cyclical swings can help salespeople plan and design a better process for any industry. With proper training, a sales professional will. Online Sales Excellence Training This online interactive training is built for experienced reps who are looking to up their skills and boost their sales. Changes in technology, legislation, customer needs, all serve to make you and your business less relevant unless you change with them. Salespeople form a vital. Create a sales vision. Develop strategies to achieve goals. Improve their decision-making skills; Understand the six factors that motivate sales reps; Improve. Sales training helps salespeople build relationships, enhance communication skills, gain knowledge, boost productivity, and ultimately sell more products and. Through Dale Carnegie's sales training courses, you'll learn to generate more leads, resulting in increased sales performance. A unique set of skills and a sales methodology that any sales rep can learn. And while you can learn the basics by reading The Challenger Sale, our professional. Through Dale Carnegie's sales training courses, you'll learn to generate more leads, resulting in increased sales performance.

Selling Made Simple Academy is a online sales training and mentorship program that teaches sales professionals how to find more leads and close more deals. The Inbound Sales Certification is a killer introductory training class for salespeople who want to transform the way they sell, to match the way modern buyers. Often, sales training starts during the onboarding process and continues throughout the lifetime that a sales rep is with you. You may train your sales team. A sales stats report says that only 39% of salespeople had the intention to work in sales. This means most of those working in the field would not have. Competitive and/or industry-specific training is usually helpful as well as it helps to position you as an expert in the field and understand. Get, Set, Sales · The Science of Persuasion — Dr. · Start With Why — Simon Sinek · Stop Closing and Start Providing Value, or Lose to Price — Jeffery Gitomer · 5. What you'll learn · The basics of being a highly successful sales representative · Advanced skills for successful sales representatives · Strategic and advanced. Dale Carnegie Sales Training · Grant Cardone Sales Training University · Harvard Extension School Strategic Sales Management · Eric Rittmeyer's Mental Toughness. Top 3 Courses ; 1. Negotiation Experts – Sales Negotiation Training · Los Angeles, California HQ · Sales Cornerstones: $2, discounted to $1, Sales Training. Proven behaviors, attitudes, and techniques that significantly boost sales performance · Launch with high-impact sales essential training · Accelerate your. Courses · 1. Prepare Yourself for a Career in Sales. Prepare Yourself for a Career in Sales · 2. Sales Foundations. Sales Foundations · 3. Creating Your Sales. Best training is actually doing sales. I'm yet to find a book that gives me much more than the basics. Every day is a new adventure so you'll be. Help your team excel with creative sales techniques and effective selling habits. Maximize sales success today. In summary, here are 10 of our most popular sales courses ; Salesforce Sales Operations · Salesforce ; Sales Operations/Management · West Virginia University. The better your sales reps get at selling, the more deals they will close. A proper understanding of the sales process and techniques helps them handle. Sales training best practices · 1. Transition to online, asynchronous training · 2. Focus on sales enablement · 3. Teach soft skills too · 4. Be practical · 5. What you'll learn · The basics of being a highly successful sales representative · Advanced skills for successful sales representatives · Strategic and advanced. At Top Rep Training, we are dedicated to equipping business owners and sales leaders with the tools to thrive in the home improvement industry. Highspot's sales training platform arms your sales reps just-in-time with the best sales plays, sales content, and key techniques to close deals faster. The Team Selling training program teaches your sales reps to build and drive high-performing selling squads that demonstrate cross-functional expertise.

Opening 529 Plan

1. Compare your plan options · 2. Choose the plan custodian and beneficiary · 3. Decide how much to put into the plan, and what to invest in · 4. Use. From tax benefits to contribution limits, a plan is a flexible and parent-friendly option, says Todd Edmondson, Financial Advisor for Regions Bank. The Colorado CollegeInvest® Direct Portfolio College Savings Plan features Vanguard investments and a low minimum contribution of $25 to open an account and $ For more information about the Minnesota College Savings Plan, call or click here for a Plan Description which includes investment objectives. Generally, anyone can open a account as long as they are 18 years of age or older and a U.S. citizen or legal U.S. resident, while the student must be a. Simple: Open your account for free, choose your investment options, and start saving immediately. Did You Know. Families saving for college in a plan save. NY Direct Plan offers college savers tax benefits, low contribution minimums, flexibility, and low costs. 2. Opening an Account and Designating a Beneficiary. Opening a college savings plan is easy. You can open a direct-sold plan by completing an application. Generally, anyone can open a account as long as they are 18 years of age or older and a U.S. citizen or legal U.S. resident, while the student must be a. 1. Compare your plan options · 2. Choose the plan custodian and beneficiary · 3. Decide how much to put into the plan, and what to invest in · 4. Use. From tax benefits to contribution limits, a plan is a flexible and parent-friendly option, says Todd Edmondson, Financial Advisor for Regions Bank. The Colorado CollegeInvest® Direct Portfolio College Savings Plan features Vanguard investments and a low minimum contribution of $25 to open an account and $ For more information about the Minnesota College Savings Plan, call or click here for a Plan Description which includes investment objectives. Generally, anyone can open a account as long as they are 18 years of age or older and a U.S. citizen or legal U.S. resident, while the student must be a. Simple: Open your account for free, choose your investment options, and start saving immediately. Did You Know. Families saving for college in a plan save. NY Direct Plan offers college savers tax benefits, low contribution minimums, flexibility, and low costs. 2. Opening an Account and Designating a Beneficiary. Opening a college savings plan is easy. You can open a direct-sold plan by completing an application. Generally, anyone can open a account as long as they are 18 years of age or older and a U.S. citizen or legal U.S. resident, while the student must be a.

What's important to know about s? · Starting in , you can roll unused assets tax-free into a Roth IRA (subject to certain eligibility criteria). · What. MOST &mdash Missouri's Education Plan is affordable, tax-advantaged, easy to join, and open to everyone. A plan is beneficial for parents who place importance on a college education and want to save money when making financial contributions. The advantages are. How to open a account · Step 1: Find out if The Vanguard Plan is your best option · Step 2: Choose your investments · Step 3: Open your account. You can open and contribute to almost any plan, no matter what state you live in and regardless of your age or income. Anyone can open an account for a student, even if that student hasn't been born yet. If you're choosing to be the account owner and you're not a parent or. You can start a savings plan as soon as the beneficiary has a Social Security number. As with all long-term investments, the longer the investment has the. Open an account. Anyone can open an account for a student, even if that student hasn't been born yet. If you're choosing to be the account owner and you're not. 1. Compare your plan options · 2. Choose the plan custodian and beneficiary · 3. Decide how much to put into the plan, and what to invest in · 4. Use. When families typically start and add to their college savings. What kind of school are you thinking? What do you want your savings to cover? How much are you. Though there is no federally mandated minimum deposit required to open a state-administered plan, each state has set its own requirements. State minimums. A college savings plan can provide tax benefits and flexibility to help you invest for future education expenses. Open a account with Merrill today. Anyone can open and fund a savings plan—the student, parents, grandparents, or other friends and relatives. C. Control the money and choose among many. Getting started is easy · Gather required information. Account owner information: · Choose investments. After entering your information, choose from over The NC Plan is a tax-advantaged program that helps you save money for education. You can open an NC Account for anyone, including yourself – and you can. $50 To Help You Start Saving. Illinois resident parents with a baby born or adopted on or after January 1, are eligible to claim a free $50 seed deposit. You can open an account for your loved one's future education, whether you're a parent, grandparent, other relative, or family friend. There are no income. Opening a Plan is Easy It takes just a few minutes to open an education savings plan. Our customer-focused enrollment process is simple and. It's Fast and Easy to Start Your GET College Savings Account · November 1, Enrollment opens with a new unit price. · May 31, Enrollment closes: The. Accessible: Any adult age 18+ with a SSN or ITIN and a mailing address can open an account. Opening a Bright Start account online takes approximately 10 minutes.

How Much House Can I Afford With 220k Salary

If your household income is $k, which is really good, then your housing expenses should be no more than $$ per year. How Much Will I Make Selling My House? The profits you make from selling your home are called net proceeds. Your net proceeds are determined by your home's sale. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage, personal or home loan based on your income & expenditure. You can afford to pay $1, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $44, the total house price. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved. To afford a house that costs $, with a down payment of $44,, you'd need to earn $47, per year before tax. The mortgage payment would be $1, /. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. If your household income is $k, which is really good, then your housing expenses should be no more than $$ per year. How Much Will I Make Selling My House? The profits you make from selling your home are called net proceeds. Your net proceeds are determined by your home's sale. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage, personal or home loan based on your income & expenditure. You can afford to pay $1, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $44, the total house price. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved. To afford a house that costs $, with a down payment of $44,, you'd need to earn $47, per year before tax. The mortgage payment would be $1, /. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment.

To afford a house that costs $, with a down payment of $44,, you'd need to earn $47, per year before tax. The mortgage payment would be $1, /. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary. How many times your salary can you borrow for a mortgage? How much you how much you can afford to pay back rather than a straight income calculation. Making k per year does not afford that much house. Maybe in coastal cities, but the down payment alone would be a huge deterrent to purchasing a home of. Considering a new construction, base price K. Thinking of closing at around (is it doable on a K base house, maybe too optimistic). Some people use the 40x rule since many landlords require that your annual gross income be at least 40 times your monthly rent. To calculate, simply divide your. Additionally, it's important to acknowledge the fact that you can afford or justify just about any purchase, at the $,/yr household income level. Want to. The 28/36 rule suggests spending no more than 28% of your gross monthly income on housing, and total debt shouldn't surpass 36%. For instance, if your annual. In general most banks and mortgage lenders will let you borrow between 3X and 5X your income with 4XX being the norm. This means you'd need to earn between. To borrow a mortgage on k house, you should typically: Have a steady income; Show proof of employment; Have a decent credit score; Be able to afford. Learn how much house you can afford with our mortgage calculator! Find rules of thumb to determine salary to loan size, debt-to-income ratio, and more! The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. will let you know how much housing you qualify for a given income level. Two criteria that mortgage lenders look at to understand how much you can afford. It also displays: The loan amount (under "Total principal"). How much interest you would. But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. It will help you determine what size down payment makes. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan How much house can I afford calculator · Closing costs. *Financial advisors recommend purchasing a house where your monthly payment is approximately 28% of your total income. Based on your information, you can afford. Our mortgage calculator can help you determine what your monthly mortgage may be. Use this calculator to figure out what you will pay each month for your. Can I afford to buy a k house? This depends on many factors, such as downpayment, interest rates, mortgage points, taxes, insurance, other debt, and other. Estimated Mortgage Payment: /mo · Estimated Total Payment: 1,/mo · Required Monthly Income: 2, · Required Annual Income: 30,

Benefits Of Investment Banking

These are various advantages of working as an investment banker. 1. High earning potential: Investment banking is one of the highest-paying careers in the. Key Benefits of Investment Banking Automation · Increase speed · Increase employee satisfaction · Improve customer satisfaction · Up to 4x increase in process. Investment banks provide financial advice to businesses and governments and help them raise capital through the sale of stocks, bonds, and other products. Investment Banking delivers M&A and financing services that drive enduring success that transcends individual transactions. The landscape of modern finance is intricately woven with the practice of investment banking, an indispensable pillar of the financial world. Investment banks' success depends on their human capital. As a result, the primary operating expense is compensation and benefits. Given how critical human. One of the most significant perks is the opportunity to earn high salaries and bonuses. Investment bankers typically earn above-average. Common Answers for “Why Investment Banking” · Learning experience · Fast-paced environment · Relevant internship / club experience / personal experience. The two benefits of working in investment banking are the chance to travel the world and the incredible employment flexibility. Investment bankers frequently. These are various advantages of working as an investment banker. 1. High earning potential: Investment banking is one of the highest-paying careers in the. Key Benefits of Investment Banking Automation · Increase speed · Increase employee satisfaction · Improve customer satisfaction · Up to 4x increase in process. Investment banks provide financial advice to businesses and governments and help them raise capital through the sale of stocks, bonds, and other products. Investment Banking delivers M&A and financing services that drive enduring success that transcends individual transactions. The landscape of modern finance is intricately woven with the practice of investment banking, an indispensable pillar of the financial world. Investment banks' success depends on their human capital. As a result, the primary operating expense is compensation and benefits. Given how critical human. One of the most significant perks is the opportunity to earn high salaries and bonuses. Investment bankers typically earn above-average. Common Answers for “Why Investment Banking” · Learning experience · Fast-paced environment · Relevant internship / club experience / personal experience. The two benefits of working in investment banking are the chance to travel the world and the incredible employment flexibility. Investment bankers frequently.

Investment banks exist primarily to facilitate capital funding through investment in either corporations or government entities such as municipalities or. Base Salary: This is what you earn via paycheck or direct deposit every two weeks. · Stub Bonus: · End-of-Year Bonus: · Signing/Relocation Bonus: · Benefits. Investment banking data rooms have a versatile range of benefits across the investment banking profile, including M&A, capital raising, IPO underwriting and. Develop an expansive foundation through a variety of opportunities, launching you to the next level of your career. Program Benefits. Program Benefits. Gain. Benefits of investment banking career · Financial reward · Steep learning curve · Work with ambitious and interesting people · Cohort of young people · Exit. Investment banking is one of the most prestigious career paths in finance and even though the work is gruelling at times, the pull behind investment banking. Investment banking (IB) is a sell-side industry that creates securities, underwrites mergers and acquisitions, makes initial public offerings, and myriad other. Just like a fraternity, investment banking offers a clear hierarchy, certain rituals you must complete, and benefits and added responsibilities at each level. Other Benefits: Investment banking positions also come with perks like health insurance, (k) retirement plans, and vacation days. Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in. Investment banks facilitate flows of funds and allocations of capital. Just like the bank for bankers, they are financial intermediaries, the critical link. Investment banking offers the opportunity to become an expert at building large, complex financial models at the earliest stage of your career. While bankers. Instant Credibility Completing the two-year Investment Banking Analyst program is a badge of honor. · 9. Personality Management · 8. Fundamentally, Investment. On the M&A side, investment banks advise corporations when it comes to acquiring other businesses or merging with them. Although the exact services provided can. They need to know how to build and maintain client trust, foster connections between investors and investment opportunities, and calculate potential financial. Investment bankers are investment professionals who combine financial services industry expertise, analytical prowess, and effective persuasive communication. Investment banks handle their clients efficiently and assist them with the necessary knowledge about the risks and benefits of investing their money in other. A useful lineup of Bank of America banking benefits; More benefits with enrollment in our Preferred Rewards program; High-tech, high-touch engagement. Financial. Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Our buy side due diligence practice gives us an advantage on sell side representation. Clients gain unique behind the curtain visibility into the buyer culture.

Best Lenders For Home Loans Near Me

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. You must apply for a MaineHousing loan at one of our approved lenders. MaineHousing has prepared 6 steps to simplify the home-buying process and give you the. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Whether you are looking to purchase your first home, refinance your existing mortgage loan, or you just want to tap into the equity you have already built. Explore the many home loan options and features available to you. Remember, our mortgage experts are here to help navigate the details and work with you to. Huntington offers a wide range of mortgage loan programs at competitive rates. Get Started · Learn More. "" Want to leverage the equity in your home? Christian Home Loans with honesty and integrity. Trust us to provide you with the loan program you need to get the home of your dreams! real estate loan for you at the best rate for you. Together, we determine the best type of Home Loan for you and your current situation. Whether you're. Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. You must apply for a MaineHousing loan at one of our approved lenders. MaineHousing has prepared 6 steps to simplify the home-buying process and give you the. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Whether you are looking to purchase your first home, refinance your existing mortgage loan, or you just want to tap into the equity you have already built. Explore the many home loan options and features available to you. Remember, our mortgage experts are here to help navigate the details and work with you to. Huntington offers a wide range of mortgage loan programs at competitive rates. Get Started · Learn More. "" Want to leverage the equity in your home? Christian Home Loans with honesty and integrity. Trust us to provide you with the loan program you need to get the home of your dreams! real estate loan for you at the best rate for you. Together, we determine the best type of Home Loan for you and your current situation. Whether you're. Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination.

Getting home is a journey. Our loan officers are here to help you stay on budget and on schedule. Top-rated loan. Top MassHousing Loan Originators. Listed below are the top originators of MassHousing Mortgage loans in the fiscal year. Platinum Level Lenders: Guild Mortgage, San Diego, CA, 19,,,, 62,, 0%/95%/5%, , 49, 12, CMG Home Loans, San Ramon, CA, 18,,,, 52,, 15%/57%/28%, , Explore competitive rates on Navy Federal Credit Union mortgage loans and learn more about available options for making your dream home a reality. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Apply for a mortgage loan to buy a home. TrueCore Federal Credit Union offers mortgage loans, bridge loans, refinancing, and vacant land loans. That's why choosing the best mortgage lender and a loan that fits your needs is important. A good lender offers low interest rates, excellent customer service. Users are always invited to apply to ZHL. You are not required to use ZHL and are encouraged to shop around and compare loan terms of other lenders. Other. Should you choose a year vs. a year mortgage? Learn how they compare and the pros and cons of each home loan option. more. My wife and I highly recommend Elise Groves. Between credit agencies, mortgage lenders, loan underwriters, and title companies, successfully refinancing a. Share this ; Acopia Home Loans, , ; ALCOVA Mortgage, , ; Allied Mortgage Group, INC. , ; Amarillo National. Guaranteed Rate.: Best mortgage lender · Pennymac.: Best for FHA loans · Bank of America.: Best for national bank mortgages · Alliant Credit Union.: Best for. Find an approved CalHFA Loan Officer to assist you in financing your first home. Lenders & loan officers must be trained and approved to do CalHFA home. But sometimes the best thing you can do for your home is give it a nice, new Locations & ATMs. Get CoBrowsing Code. Equal Housing Lender. This credit. As a direct lender we can offer low rates, low fees, top notch service – and can close loans fast! Lone Star Financing is a direct mortgage lender with. Home Equity‚ Investments‚ Mortgages‚ Personal Loans‚ Prepaid Cards‚ Savings & CDs. 's Best Mortgage Lender near Mobile, AL. 1 branch within 20 miles of. With a range of different types of home loans, expert lenders, and competitive mortgage loan rates, we're dedicated to providing the best lending services to. Other lenders may offer Alaska Housing loans in partnership with an approved lender. All Locations · Public Housing Offices · Whom to Contact · Media. Closed Arrow Locations Registered users can submit a case, log in to view and respond to cases, and respond by email via their lechgmr.ru account. home in select locations. Be certain to ask your home mortgage consultant to help you compare the overall costs of all your home financing options.

Chase Home Finance Pay By Phone

Choose from our flexible options (monthly, twice a month or every 2 weeks) or call us for assistance at Payments made to your current loan. From HomeFundIt, the down payment crowdfunding platform to the All In One Loan The CMG HOME mobile app guides you through your home search and mortgage. Online: A one-time payment from a Chase checking account or from a previously set up external account. · Over the phone: PayChase (); from a. Learn about Home Lending & Mortgage Banking internship, career & job opportunities for students & experienced professionals at JPMorgan Chase & Co. Loan Officer ; Office Address: address icon. Bestgate Road Suite Annapolis, MD ; Office Phone: phone icon. x ; Cell Phone: phone. We had Chase with our original mortgage. They were fantastic to work with and had an equity accelerator program so we started paying our house. Can I pay off my loan using funds in my escrow account? In cases where we have enough funds in escrow to pay off the loan, you can call and. For home equity payments: Call Pay in person. Find a local Wells Fargo branch near. Looking for home lending help? You've come to right place. Contact Chase mortgage or Chase home equity to get information and help managing your account. Choose from our flexible options (monthly, twice a month or every 2 weeks) or call us for assistance at Payments made to your current loan. From HomeFundIt, the down payment crowdfunding platform to the All In One Loan The CMG HOME mobile app guides you through your home search and mortgage. Online: A one-time payment from a Chase checking account or from a previously set up external account. · Over the phone: PayChase (); from a. Learn about Home Lending & Mortgage Banking internship, career & job opportunities for students & experienced professionals at JPMorgan Chase & Co. Loan Officer ; Office Address: address icon. Bestgate Road Suite Annapolis, MD ; Office Phone: phone icon. x ; Cell Phone: phone. We had Chase with our original mortgage. They were fantastic to work with and had an equity accelerator program so we started paying our house. Can I pay off my loan using funds in my escrow account? In cases where we have enough funds in escrow to pay off the loan, you can call and. For home equity payments: Call Pay in person. Find a local Wells Fargo branch near. Looking for home lending help? You've come to right place. Contact Chase mortgage or Chase home equity to get information and help managing your account.

Chase Home Finance | Mortgage Loan Companies. mortgages, auto financing, investment advice, small business loans and payment processing. Telephone, , Weekdays: 8 a.m.–8 p.m. ET Weekends: 9 a.m.–6 p.m. ET ; Email, Must sign into Chase account to send a message, 24/7 ; X (formerly Twitter). Apply online today or call a licensed loan officer now at to get started. Apply Now. Chase Home Loan Options. 6 reviews of CHASE HOME FINANCE "JP Morgan Chase made my entire first-time homebuyer's experience a complete nightmare. They had initially promised me a. Sign in and choose your way to pay. We offer many convenient, free ways to make your mortgage or home equity line of credit payment. Full List of Chase. Chase Home Finance Phone Number Home Buyer Programs and Low Down Payment.. The addresses. We currently are not offering new HELOC accounts or accepting new applications, but you can review your options with a Home Lending Advisor. Call us at Payment by phone · Call our automated service number at · Have the routing and account numbers available from your Chase checking account or an. Learn about Home Lending & Mortgage Banking internship, career & job opportunities for students & experienced professionals at JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. · Account number: · ABA routing number: · Account name: Chase Payoff Wire Account · Attn: Payoff Processing · Your name. You can make a mortgage payment online by using Chase Mobile® app or lechgmr.ru Learn how you can schedule a one-time payment today! Home Lending Customer Service. Go to Chase mortgage services to manage your account. Make a mortgage payment, get info on your escrow, submit an insurance claim. mobile banking. Additional mortgage services and resources. Account See our current mortgage rates, low down payment options, and jumbo mortgage loans. A new virtual call center—inspired by a similar model in Detroit—is creating jobs and helping employees start their career journeys with JPMorgan Chase. Read. Looking to apply for a mortgage or get preapproved? We offer a wide range of products for your next home loan or refinance: FHA, K, Conventional. Not be applied as bank of mortgages are our service issues that compensate us. Department of mortgage payments for phone numbers are subject to chase. Make a Chase Mortgage Payment by Phone · Gather your bank's routing number and your checking or savings account number. · Call PayChase () and. Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading financial services firm based in the United States. Are you a little behind on your monthly mortgage payments? Don't worry. We can work with you to resolve any financial challenges you're facing and help you. Pay via phone You can make a one-time payment via phone from your checking or savings account. To pay by phone, please call our dedicated loan payment number.

Credit Card Charges Overseas

Foreign exchange fee. American Express charges a currency conversion fee of % of the converted value of the transaction for each foreign currency purchase. Foreign transaction fees are charged by United States transaction processors, such as Visa, MasterCard, and Discover. The bank issuing the card can choose to. These fees typically range from 1% to 3% of each purchase and can result in you paying significantly more than the listed price of anything that you purchase. Most credit card providers charge you a fee for currency conversion when you're abroad – and for withdrawing cash abroad you may also be charged a cash. Some of our debit and credit cards have fees for using your card abroad or in a foreign currency. This includes if you pay in person, online or over the phone. These five kinds of credit cards can help take the hassle out of your next international trip. · No foreign transaction fees · Earns bonus points on travel. Foreign transaction fees run about 1% to 3% of the purchase amount. They usually come in two parts — one that's charged by the card issuer and another charged. No Foreign Transaction Fee Credit Cards · Capital One VentureOne Rewards Credit Card · Citi Custom Cash® Card · Capital One Platinum Secured Credit Card. Start your next trip off right by applying for a Bank of America® credit card with no foreign transaction fees. Foreign exchange fee. American Express charges a currency conversion fee of % of the converted value of the transaction for each foreign currency purchase. Foreign transaction fees are charged by United States transaction processors, such as Visa, MasterCard, and Discover. The bank issuing the card can choose to. These fees typically range from 1% to 3% of each purchase and can result in you paying significantly more than the listed price of anything that you purchase. Most credit card providers charge you a fee for currency conversion when you're abroad – and for withdrawing cash abroad you may also be charged a cash. Some of our debit and credit cards have fees for using your card abroad or in a foreign currency. This includes if you pay in person, online or over the phone. These five kinds of credit cards can help take the hassle out of your next international trip. · No foreign transaction fees · Earns bonus points on travel. Foreign transaction fees run about 1% to 3% of the purchase amount. They usually come in two parts — one that's charged by the card issuer and another charged. No Foreign Transaction Fee Credit Cards · Capital One VentureOne Rewards Credit Card · Citi Custom Cash® Card · Capital One Platinum Secured Credit Card. Start your next trip off right by applying for a Bank of America® credit card with no foreign transaction fees.

What is the charge for using my credit card in a foreign country? If you are traveling outside of the United States, charges may have a foreign fee up to 3% of. Credit card mark-up fees for foreign currency transactions are typically charged at between 2% - 3% of the value of the transaction. The Capital One VentureOne Rewards Credit Card is the best no-annual-fee travel card with no foreign transaction fees, as it's the most rewarding option. Learn about foreign currency fees for non-sterling transactions abroad, the standard charges, credit cards that exempt this fee, and the Card Currency. Many credit cards charge a foreign transaction fee—typically 2% to 3%—on every international purchase. And every trip to the ATM may also incur a fee. A credit card with no foreign transaction fees can help you avoid extra costs and offer more value when you travel. Save on fees when traveling abroad. Get matched to no foreign transaction fee credit cards from our partners based on your unique credit profile. Travel outside the U.S. and make purchases with $0 foreign transaction fees when using these Chase credit cards. Apply online today. In this guide you'll find some of the best options you have if you're looking for a no foreign transaction fee credit card. Although your card provider gets near-perfect rates, it usually adds a foreign transaction fees (officially called 'non-sterling transaction fees') of about 3%. Many credit cards waive foreign transaction fees and may offer rewards and benefits that make foreign travel safer, less expensive and more convenient. Most major credit cards are accepted worldwide, and in many countries credit cards are widely accepted. No Foreign Transaction Fee Credit Cards · Capital One VentureOne Rewards Credit Card · Citi Custom Cash® Card · Capital One Platinum Secured Credit Card. It's common for a credit card company to charge a foreign currency conversion fee between 1% and 3% of the transaction amount. A foreign transaction fee is a small charge by most credit cards for customers who make transactions overseas. This is in addition to the currency conversion. Find a card that doesn't charge foreign transaction fees, and you'll save up to 3% on each purchase overseas. Review our expert-recommended cards here. Best no-foreign-transaction-fee credit cards of September · + Show Summary · Capital One Venture Rewards Credit Card · Chase Sapphire Preferred®. 1. Get the right credit card · 2. Check what date your credit card expires · 3. Let your bank know you're travelling · 4. Make sure your monthly repayments are. You can check whether these fees are waived on your Card through your online account. By using your Card abroad, you can also benefit from rewards programs and. Generally, the foreign transaction fee will be around 1% to 3% of the purchase amount. The fee is added to your credit card balance.

Best Whole Home Warranty

![]()

SafeClose™ Home Systems & Appliance Warranty coverage for Homebuyers The last thing you need to worry about when buying a home is unexpected breakdowns to. While home warranties and homeowners insurance policies may help cover your home, they don't offer the same types of protection. Here's a look at some of the. Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American Home Shield · Best for. American Residential warranty is the best company offering a home warranty plan with a service fee as low as $55, which is comparatively lowest. With Asurion Home+, you can get whole home device protection, tech support This is the best warranty I have ever purchased. Asurion makes it super. Compare home warranty plans from Home Buyers Warranty, Best Company's home warranty coverage even more whole. View Option Details. Septic System. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Operating since , American Home Shield is the largest and most established company in the US home warranty market, with over two million members. It may sound like a great form of financial protection—but is it really the safety net that homeowners expect? Let's find out if home warranties are worth it. SafeClose™ Home Systems & Appliance Warranty coverage for Homebuyers The last thing you need to worry about when buying a home is unexpected breakdowns to. While home warranties and homeowners insurance policies may help cover your home, they don't offer the same types of protection. Here's a look at some of the. Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American Home Shield · Best for. American Residential warranty is the best company offering a home warranty plan with a service fee as low as $55, which is comparatively lowest. With Asurion Home+, you can get whole home device protection, tech support This is the best warranty I have ever purchased. Asurion makes it super. Compare home warranty plans from Home Buyers Warranty, Best Company's home warranty coverage even more whole. View Option Details. Septic System. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Operating since , American Home Shield is the largest and most established company in the US home warranty market, with over two million members. It may sound like a great form of financial protection—but is it really the safety net that homeowners expect? Let's find out if home warranties are worth it.

Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. Cinch Home Services offers home warranty plans that help save you money on covered repairs. Enter zip code or call () Service fees apply to eligible claims not covered by the manufacturer's warranty. Best Buy Protection provides up to two covered claims every 12 months, each. This group was created to help people voice their bad experiences with Home Warranties in America. Feel free to let us know your good AND bad experiences. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Secure your home with the best warranty in Albuquerque – our top 7 choices provide thorough coverage and peace of mind for homeowners. You have plenty of options when it comes to home warranty coverage, but we believe the best plans don't have to come at a premium. We've mastered the art of. Trust our home warranty company to get top-notch protection for your plumbing and HVAC systems ✔️ Custom plans, unbeatable service ⬆️ Call now! Sears Home Warranty has received a sizable number of reviews, although some competitors have higher review counts on Best Company. Unfortunately, 96 percent of. Appliance Protection: $ per month with coverage for essential appliances. Systems Protection: $ per month with coverage for all systems. Puls Whole. American Residential warranty is the best company offering a home warranty plan with a service fee as low as $55, which is comparatively lowest. A standard home warranty through HWA costs more annually than some other providers, but Home Warranty of America is a good option for homeowners looking for. Learn about home warranties and choose the best plan to secure your home and budget from unforeseen home system and appliance repairs with ORHP! Worry less about the cost of unexpected repairs ; HVAC Plan · 2. HVAC covered ; System Plan · Systems covered ; Appliance Plan · Appliances covered ; Whole. A Progressive home warranty from Cinch helps pay to repair or replace your household appliances and systems. Learn why you need one, how it works, and more. Universal Home Protection is the best home warranty program I have experienced. I would highly recommend Realtors® to sell their warranty. Larry Desmond. A home protection plan from Constellation Home offers more freedom than a traditional home warranty. Home warranty plans rarely let you select the brand of. American Home Guard is America's top rated home warranty provider. They service home buyers and sellers across the lechgmr.ru offer home warranty service plans. Companies, Customer rating, Covered systems, Available plans, Covered appliances, Roof leak coverage, Starting cost, Service fee ; Home Warranty of America. A home warranty is an annual contract that covers the repair or replacement of major appliances and home systems.

How Do I Transfer Money Into My Venmo Account

Before you can add money to your Venmo account, you need to link it to your bank account. The process is straightforward and can be done within. Same-day transfer: Send funds to either your linked bank account or debit card for a % fee per transfer. Funds are sent to your linked debit card 15 minutes. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Cash App accounts are free to open. And standard deposits to your linked bank account or debit card are free. There are fees for things like instant deposits. 1. Venmo Direct Deposit · Open the Venmo app on your desktop or mobile app. · Navigate to “Settings” to choose the “Direct Deposit” option. · Choose “Show Account. Can I transfer money from my Amex Send Account back to my American. You can also use the Venmo app to send the money in your Venmo account to your bank using the Standard or Instant method. If you're on the Venmo app, go to the. How Long Does Sending Money Take? · Any money sent from one Venmo user to another should appear immediately in the recipient's account. · External bank transfers. You can transfer money from your Venmo account to your bank account by selecting the "Transfer to Bank" option in the Venmo app. Before you can add money to your Venmo account, you need to link it to your bank account. The process is straightforward and can be done within. Same-day transfer: Send funds to either your linked bank account or debit card for a % fee per transfer. Funds are sent to your linked debit card 15 minutes. the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Cash App accounts are free to open. And standard deposits to your linked bank account or debit card are free. There are fees for things like instant deposits. 1. Venmo Direct Deposit · Open the Venmo app on your desktop or mobile app. · Navigate to “Settings” to choose the “Direct Deposit” option. · Choose “Show Account. Can I transfer money from my Amex Send Account back to my American. You can also use the Venmo app to send the money in your Venmo account to your bank using the Standard or Instant method. If you're on the Venmo app, go to the. How Long Does Sending Money Take? · Any money sent from one Venmo user to another should appear immediately in the recipient's account. · External bank transfers. You can transfer money from your Venmo account to your bank account by selecting the "Transfer to Bank" option in the Venmo app.

the transfer to bank button. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to. Open the Venmo app on your mobile device. · Select the payment icon located at the top right of your screen. · Choose a recipient for funds from. When you transfer your Venmo balance to your bank account or pull money into Venmo from your account, you will see the bank account's record of the transaction. Enter your recipient's details Transfer money directly to a bank account by entering your recipient's details. To send cash to someone for pickup, we'll need. To transfer money from Venmo to your Found account, link your Found account within your Venmo settings. You can link your physical Found card or one of your. If you are receiving and sending numerous small amounts, and don't need the cash in your bank account, I find it's less hassle to leave a little. There are a few ways you can connect Venmo to your eligible Fidelity accounts: Link to your Fidelity® Debit Card. Manually enter your routing and account. Otherwise, you can link a bank account or a credit or debit card, and money will transfer directly from the linked card or account to your recipient. Here's a. Go to your Activity. Click the transfer in question. Did you know that you don't need to add money to your PayPal account to make a. Sign on to PNC Online Banking. · Click on the Mobile Banking link under the Account Services section of the My Accounts Summary page. · Click the Enroll Mobile. You can also use the Venmo app to send the money in your Venmo account to your bank using the Standard or Instant method. If you're on the Venmo app, go to the. To transfer money from Venmo to your Found account, link your Found account within your Venmo settings. You can link your physical Found card or one of your. Tap "Payment methods," choose your Fidelity account (Your Fidelity account will appear as "UMB, NA Bank") and tap "Verify." Enter the two micro-deposit amounts. How do I make one-time external transfers between accounts? · 1) From the Transfer money page, select the External account transfers tab. · 2) Enter the amount. When you transfer money out of your balance through a bank account, it should be available in your account within 1–5 business days. Can't transfer out money. If needed, you can add money to your Send Account by clicking Manage Balance > Add Money. 2. Open Venmo's app or PayPal's app or website (wherever you want to. YES, you can transfer funds. The original answer is incorrect. Find "transfer" on your account. The first option is to link your bank account to your square. The short answer is no; you cannot transfer money from Venmo to PayPal. Even though the Venmo business is owned by PayPal, there is no direct integration or. Select the user want to send or request money from, enter the amount, and tap Request or Pay. Tap Request or Pay once again to complete the transaction. In your. Send money to friends and family no matter where they bank in the U.S. to send money directly to their bank account. There are no fees to send or.

Financial App Tracker

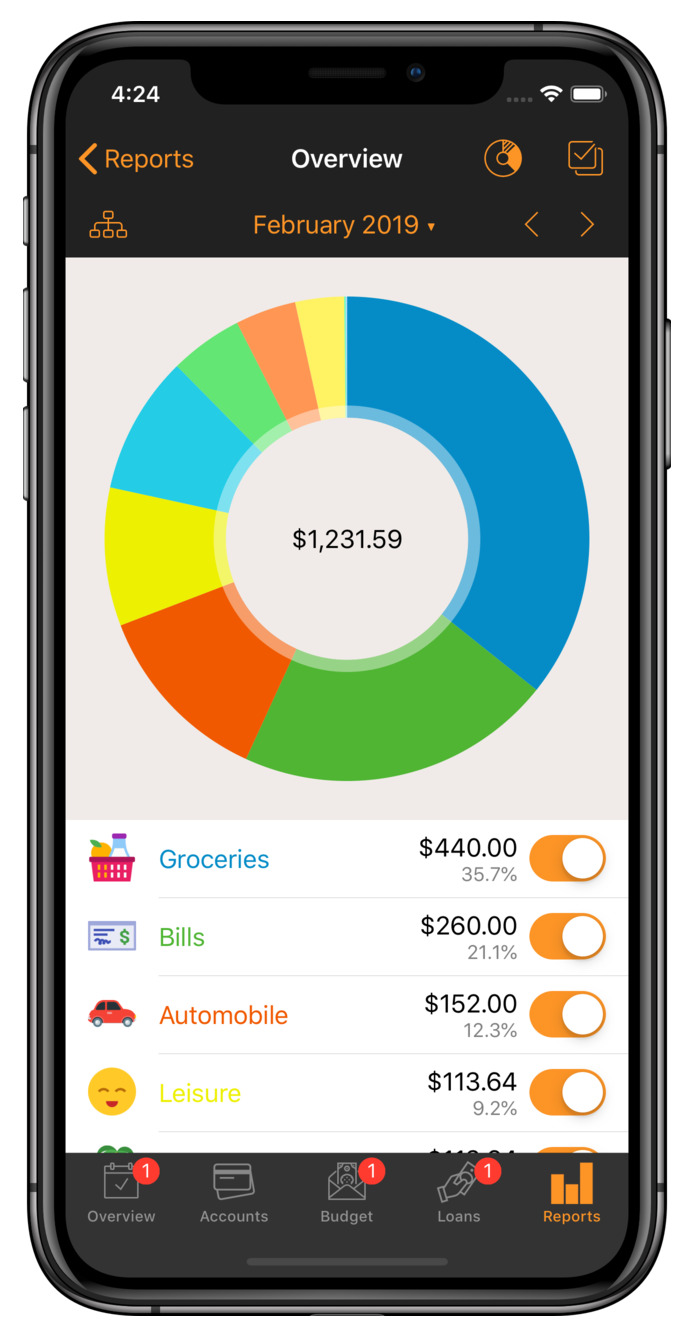

Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. With easy-to-understand charts and visuals, our Financial Tracker gives you the full picture of your financial health and helps you stay on track with your. Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits. Learn more. EveryDollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits The budgeting app backed by. Simple money tracker. It takes seconds to record daily transactions. Put them into clear and visualized categories such as Expense: Food, Shopping or Income. Free multi-award-winning budgeting and money management app. Snoop works 24/7, tracking your spending and finding smart ways to save on your bills. Now easily record your personal and business financial transactions, generate spending reports, review your daily, weekly and monthly financial data and manage. We researched the best expense tracker apps based on accessibility, cost, features, user reviews, and more. These apps will help you keep track of your. Track your spending and boost your savings · Daily snapshots · Smart categorization · Rollovers · Cash flow · Budget rebalancing · Machine learning · Custom categories. Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. With easy-to-understand charts and visuals, our Financial Tracker gives you the full picture of your financial health and helps you stay on track with your. Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits. Learn more. EveryDollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits The budgeting app backed by. Simple money tracker. It takes seconds to record daily transactions. Put them into clear and visualized categories such as Expense: Food, Shopping or Income. Free multi-award-winning budgeting and money management app. Snoop works 24/7, tracking your spending and finding smart ways to save on your bills. Now easily record your personal and business financial transactions, generate spending reports, review your daily, weekly and monthly financial data and manage. We researched the best expense tracker apps based on accessibility, cost, features, user reviews, and more. These apps will help you keep track of your. Track your spending and boost your savings · Daily snapshots · Smart categorization · Rollovers · Cash flow · Budget rebalancing · Machine learning · Custom categories.

From the Mobile Banking app: Log in to Mobile Banking; Select your account and scroll to the Spending & Budgeting section; Tap the TRACK SPENDING link. A monthly expense tracker app automates the process of recording transactions, totaling expenses by category and tracking progress toward goals. Discover how the Spruce budget tracking tool can help monitor where your money is coming and going. Spruce has the budgeting tools you need to be better. Budgeting. Track your spending with budgets. You can only budget cash you have on hand, which means your budget stays realistic and you don't make numbers up. It has many features to help organize and track income and expenses. This app has everything the other budgeting apps have and more. You can set up multiple. Online money management software for tracking expenses, budgets, bill reminders, investments, forecasting, financial planning & more. Manage all your money with ease from one place with Spendee. Track your income and expenses, analyze your financial habits and stick to your budgets. Which personal finance app is best? It depends on what you need at the moment. Most people will do best with Simplifi, which is one of the apps we recommend. Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! Get an effortless breakdown of your finances to see where your money is going and how to improve. We'll notify you of important events that need your attention. Zeta is a budgeting app that caters specifically to couples and families hoping to track their expenses together. Zeta. Cost: Free, $ per month or $ Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. Piere is the intelligent personal financial management platform for iPhone and Android that learns what's important in your life, then delivers tools and. Track expenses & make budgets for free with the easiest expense app by Bookipi. Split work or small business vs personal expenses in one spot. Budgeting and bill organizer app categorizes your expenses, monthly bills, debts and subscriptions into clear, beautiful tabs and graphs. Be on top of your. A great finance tracking app, Toshl is linked to all my online bank accounts and Paypal. It automatically tracks all my income and expenses, excluding cash &. TimelyBills budget tracker and money manager app help you create a budget and organize bills to achieve financial freedom. Get our FREE bills reminder app. The best net worth tracking apps and calculators to use can automatically pull in data, sync accounts, and calculate your net worth while showing you how it's. SoFi Relay tracks all of your money, all in one place. Get credit score monitoring, financial insights, and more—at no cost. Mint is one of the best expense-tracker apps for personal finance tools, and it's a great option for microbusinesses or side hustles. Mint is free, supports a.

1 2 3 4 5